Let's face it: life is unpredictable. One moment you're cruising along, the next you're staring down a stack of unfamiliar paperwork, a looming legal question, or a situation that feels way over your head. This isn't just about big crises; it's about the everyday legalities of buying a home, planning for your family's future, or even dealing with a pesky traffic ticket. For many, the answer lies in understanding and truly Maximizing Your MetLife Legal Plan Benefits.

You might already be enrolled through your employer, seeing a small deduction on your paycheck. But are you actually tapping into the incredible peace of mind and financial savings this plan offers? Too often, legal plans sit dormant until an emergency, when in reality, they're designed to proactively simplify your life and protect your interests. This guide isn't just about what your plan covers; it's about how to use it like a seasoned pro, turning a potential headache into a streamlined process.

At a Glance: Your MetLife Legal Plan Superpowers

- Nationwide Attorney Network: Access over 18,000 pre-qualified, experienced attorneys across the U.S.

- Zero Hidden Costs: Enjoy no copays, no deductibles, and no usage limits for covered matters.

- Broad Coverage: From estate planning and real estate transactions to adoption and identity theft, a wide range of personal legal needs are covered.

- Digital Empowerment: Utilize an award-winning client portal, live chat, 24/7 AI assistance ("Ask Lexi"), and a vast self-help document library.

- Proactive Tools: Draft wills online, email network attorneys with questions before scheduling a meeting, and access 1,700 legal documents.

- Significant Savings: Avoid typical hourly legal fees, which average upward of $391, making your annual plan cost incredibly efficient.

- Customized Attorney Search: Filter attorneys by experience, legal matter, cultural sensitivity, gender, language, race, and specific expertise to find the perfect match.

Why a Legal Plan? The Unseen Costs of Life's Legalities

Imagine needing legal help. What's the first thing that comes to mind? Likely the cost. Attorney fees can quickly escalate, with the average hourly charge for legal assistance often soaring past $391. Even a simple consultation can be a significant expense, creating a barrier that prevents many from seeking the professional guidance they desperately need. This is where the fundamental value of a MetLife Legal Plan truly shines.

It’s more than just a safety net for crises; it’s an active tool for managing the predictable and unpredictable legal aspects of modern life without breaking the bank. Think about it: legal needs touch almost every major life event. Getting married, buying your first home, welcoming a child, navigating a school hearing, or even updating your will – each carries legal implications. Without a plan, these moments can become financially daunting and emotionally draining. With MetLife Legal Plans, you transform these potential financial burdens into easily manageable tasks, ensuring you have expert advice on your side from the outset.

Your Gateway to Justice: Navigating the MetLife Legal Network

The backbone of your MetLife Legal Plan is its expansive, high-quality attorney network. We're talking about a carefully curated roster of over 18,000 pre-qualified, experienced attorneys spread across the entire country. This isn't just a random list; these are legal professionals who have been vetted to meet MetLife's rigorous standards, ensuring you receive competent and reliable representation.

Finding the Right Legal Partner

One of the most powerful features of your plan is the ability to connect with an attorney who truly understands your unique needs. MetLife empowers you to filter its vast network using specific criteria, including:

- Experience Level: Do you need a seasoned veteran or someone with specific niche expertise?

- Legal Matter Focus: Ensure the attorney specializes in your exact issue, be it real estate, family law, or estate planning.

- Cultural Sensitivity & Language: Find an attorney who can communicate effectively and respects your background. You can filter by gender, language, and race.

- Geographic Proximity: While many services can be remote, sometimes an in-person meeting is preferred.

This granular search capability means you're not just getting an attorney; you're getting the right attorney for you. This personalized matching process significantly enhances the quality of your legal support experience.

Unrestricted Access, Transparent Costs

Perhaps the most compelling financial benefit is the complete absence of hidden fees. With your MetLife Legal Plan, there are:

- No Copays: You won't pay a fee each time you consult with an attorney.

- No Deductibles: There's no minimum amount you need to pay out-of-pocket before your benefits kick in.

- No Usage Restrictions: For covered matters, you can consult with attorneys multiple times a year, whether it's for a quick question, document review, or ongoing representation.

This transparency means you can approach legal issues without the constant worry of mounting costs. Attorneys within the network provide a comprehensive range of services, from initial consultations and detailed document drafting or review, all the way to robust court representation when necessary. It's truly an all-inclusive approach to legal support.

Beyond Attorneys: Leveraging MetLife's Digital Tools & Support

While access to experienced attorneys is paramount, MetLife Legal Plans extend far beyond direct legal representation. The platform is engineered with a suite of cutting-edge support tools and features designed to make legal help more accessible, efficient, and user-friendly. These digital resources are often underutilized, yet they can be instrumental in managing your legal affairs proactively.

Your Digital Legal Hub

At the heart of your plan's digital ecosystem is an award-winning client service center and member portal. This is your personalized dashboard for all things legal. Through the portal, you can:

- Communicate on Your Terms: Reach out via phone, chat, email, or directly through the online interface, choosing the method that best suits your schedule and preference.

- Track Your Cases: Monitor the progress of your legal matters, view documents, and stay informed every step of the way.

- Find Attorneys: Use the intuitive search functionality to locate and connect with network attorneys.

Real-Time Assistance & AI Smarts

For immediate questions and quick guidance, MetLife offers several dynamic tools:

- Live Chat: During business hours, a "live chat" feature connects you directly with a client service representative who can answer service and coverage questions in real-time. This is perfect for those quick clarifications that save you from making a phone call.

- Ask Lexi (24/7): For those late-night or early-morning queries, the "Ask Lexi" chat tool is available 24/7. Powered by AI, Lexi provides helpful articles and guides, offering immediate information on common legal topics and guiding you toward relevant resources.

Empowering Self-Service & Proactive Planning

MetLife also provides robust resources for those who prefer to tackle certain tasks themselves or want to be better prepared:

- Self-Help Legal Library: Dive into a comprehensive library offering access to over 1,700 legal documents. Whether you need a simple contract template, a power of attorney form, or guidance on specific legal procedures, this library is an invaluable asset.

- Online Estate Planning: Estate planning often feels daunting, but MetLife simplifies it. You can complete your entire estate planning process online, creating essential documents like wills, living wills, and powers of attorney with guided assistance. This feature alone can save you hundreds, if not thousands, in typical attorney fees.

- "Ask An Attorney" Feature: This is a game-changer for preliminary questions. Before you even schedule a meeting, you can use the "Ask An Attorney" feature to email a network attorney with specific legal questions. This allows you to get initial guidance, assess the complexity of your issue, and decide if a full consultation is needed, all without commitment.

By harnessing these tools, you can not only react to legal challenges but also proactively manage your legal life, saving time, money, and stress.

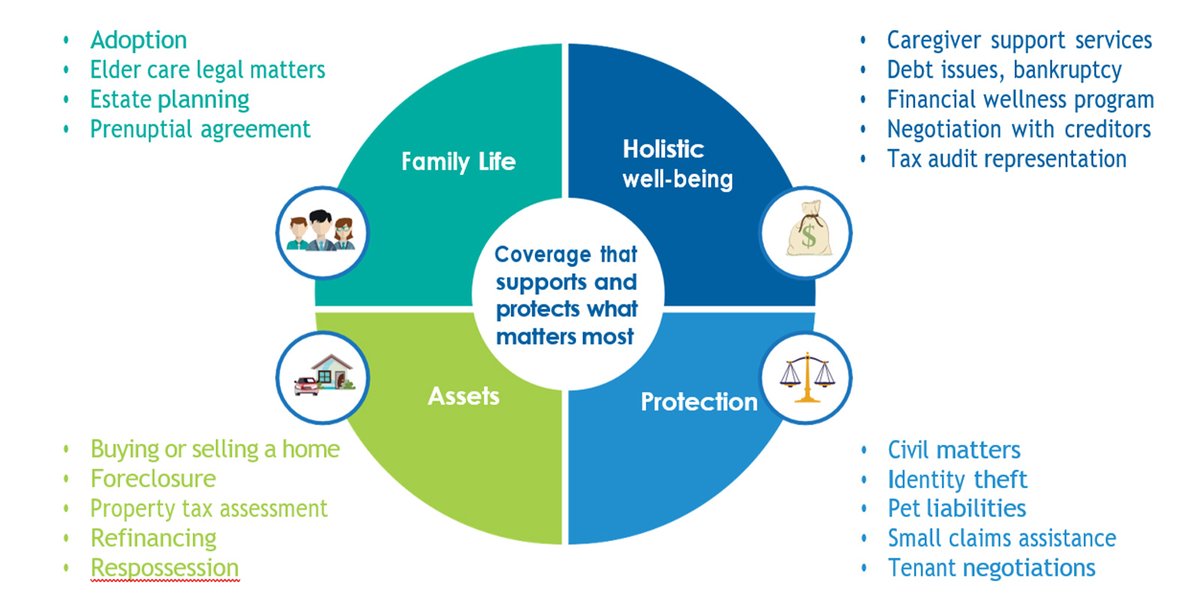

Key Covered Matters: What You Can Tackle with Confidence

The true power of your MetLife Legal Plan lies in its comprehensive scope, covering a wide array of personal legal matters that arise throughout life. Understanding these covered areas is the first step toward Maximizing Your MetLife Legal Plan Benefits. Don't wait for a crisis; identify potential future needs and recognize how your plan can help.

Here’s a breakdown of the most commonly utilized benefits:

Family & Personal Planning

- Adoption/Reproductive Assistance: Navigating the legal complexities of expanding your family, whether through adoption processes, surrogacy agreements, or other reproductive assistance legalities, can be intricate. Your plan provides the expertise to guide you through required filings and agreements.

- Wills & Estate Planning: This is a cornerstone benefit. Every adult needs an up-to-date will and a comprehensive estate plan. Your plan covers the drafting of wills, living wills, powers of attorney, and trusts, ensuring your wishes are honored and your loved ones are protected. This is often an area people procrastinate on due to perceived cost, making this benefit incredibly valuable.

Home & Property Matters

- Buying a Home: From reviewing purchase agreements and closing documents to addressing title issues, legal support during a home purchase can prevent costly mistakes and ensure a smooth transaction.

- Selling a Home: Similar to buying, selling a home involves significant legal documentation. Your plan covers review of sales contracts, disclosure forms, and negotiations, protecting your interests as a seller.

- Renting a Home: Whether you're a tenant needing lease review or a landlord facing an eviction, rental agreements and disputes fall under your plan. This includes lease drafting, review, and tenant/landlord disputes.

Unexpected Issues & Protections

- Identity Theft: The aftermath of identity theft can be a nightmare, involving complex legal steps to restore your identity and credit. Your plan can connect you with attorneys to help with communication with creditors, fraud alerts, and other recovery efforts.

- Tax Issues: Dealing with IRS audits, tax collection issues, or simply needing advice on complex tax scenarios (beyond basic tax preparation) can be incredibly stressful. Your plan offers access to legal professionals who can advise and represent you in these matters.

- Traffic Violations: From speeding tickets to more serious traffic offenses, legal counsel can help you understand your rights, negotiate fines, and potentially minimize points on your license or insurance premium increases.

This broad coverage means you have a legal expert in your corner for a wide spectrum of life's legal challenges, turning potential anxieties into manageable tasks.

Practical Steps for Maximizing Your Benefits

Having a MetLife Legal Plan is one thing; actively using it to its full potential is another. Here’s a blueprint for becoming a savvy plan user, ensuring you get the most value for your investment.

1. Know Your Coverage Inside and Out

Don't just glance at the summary; take the time to truly understand what your plan covers and any specific limitations. While MetLife Legal Plans are very comprehensive, no plan covers everything (e.g., business matters, certain criminal cases, or pre-existing conditions if not disclosed). Access your member portal, review the full benefits brochure, and use the "Ask Lexi" tool or live chat for clarifications. A clear understanding prevents surprises and helps you proactively identify situations where your plan can assist.

2. Don't Wait Until a Crisis – Be Proactive

This is arguably the most crucial tip. Many people enroll in legal plans and forget about them until an emergency strikes. Instead, leverage your plan for proactive legal health:

- Update Your Will Annually: Life changes rapidly. Births, deaths, marriages, divorces, or significant asset changes mean your will likely needs updating. Use your plan's online estate planning tools or consult an attorney for a quick review.

- Review Important Contracts: Before you sign a lease, a home purchase agreement, or an employment contract, have a network attorney review it. Catching issues before signing can save immense trouble and cost down the line.

- Consult for "Small" Questions: Have a question about a neighbor dispute, a minor traffic infraction, or a potential legal issue? Use the "Ask An Attorney" email feature. Early advice can prevent small problems from escalating.

3. Utilize All Available Tools – Not Just Attorneys

Remember those digital features? They're there for a reason!

- Self-Help Library: Need a power of attorney form or a basic template? Check the library first. You might find exactly what you need without a direct attorney consultation.

- Ask Lexi & Live Chat: For quick answers about plan features or general legal concepts, these tools provide immediate support.

- Member Portal: This is your central hub for finding attorneys, managing cases, and accessing documents. Make it a familiar resource.

4. Communicate Effectively with Your Attorney

Once you connect with a network attorney, clear and concise communication is key:

- Be Prepared: Before your first consultation, gather all relevant documents, notes, and a clear timeline of events. The more organized you are, the more efficiently the attorney can help.

- Ask Questions: Don't hesitate to ask about timelines, potential outcomes, and the next steps. A good attorney will welcome your questions.

- Follow Through: If the attorney gives you instructions or requests documents, respond promptly. This keeps your case moving forward.

5. Evaluate Your Plan's Value Regularly

Take a moment each year to reflect on how you've used your plan or how you could use it. Did you save money on a will update? Did you avoid issues with a contract review? Understanding its tangible benefits will reinforce why Is MetLife Legal Plan worth it? is often a resounding "yes" for many individuals and families. Consider how much you would have paid out-of-pocket for the services you received compared to your annual plan cost. The difference is often striking.

Common Questions & Misconceptions About MetLife Legal Plans

Even with comprehensive coverage, some questions and misunderstandings often arise. Let's clear the air on a few common points.

Is It Really Unlimited Usage for Covered Matters?

Yes, for covered matters, there are no usage restrictions. You can contact attorneys multiple times a year, or even multiple times for the same complex issue, without additional charges. This truly distinguishes it from fee-for-service models where every interaction costs you. The key is "covered matters" – ensure your specific issue falls within the plan's benefits.

What if I Need a Specialist Attorney Not in the Network?

The MetLife network is extensive, with over 18,000 attorneys covering a vast range of specialties. However, if for a highly niche or unusual legal issue you feel a network attorney isn't the right fit, or if you prefer an attorney outside the network, the plan typically won't cover their fees. It’s always best to start with the network; often, you’ll find the specialized expertise you need. Remember, you can filter attorneys by specific expertise.

Does the Plan Cover Business Legal Needs?

Generally, MetLife Legal Plans are designed for personal legal matters. They typically do not cover legal issues related to your business, side hustles, or professional ventures. If you have business legal needs, you would likely require a separate business legal plan or direct engagement with a business attorney. Always double-check your specific plan details.

Can I Use the Plan for Pre-Existing Legal Issues?

This depends on your specific plan's terms and conditions. Some plans may have limitations on covering matters that existed before your enrollment date. It's crucial to review your plan documents or contact MetLife's client service center to understand how pre-existing conditions are handled. Honesty during enrollment is always the best policy.

What About Court Representation? Is That Truly Covered?

Yes, for many covered matters, court representation is included. This is a significant benefit, as litigation can be incredibly expensive. From document preparation for court filings to appearing on your behalf, network attorneys can provide full representation within the scope of your covered benefits. Again, specific exclusions (like certain criminal cases or class-action lawsuits) may apply, so always confirm with your plan details or attorney.

The ROI of Protection: Is Your Legal Plan Worth Every Penny?

In an ideal world, we'd never need an attorney. But in the real world, legal matters are an inevitable part of life. The question isn't if you'll face a legal issue, but when, and how prepared you'll be. When you consider that the average hourly rate for legal help can easily exceed $391, the annual cost of a MetLife Legal Plan, which typically costs less than even a single hour of traditional attorney fees, becomes an undeniable value proposition.

Beyond the immediate cost savings, the return on investment (ROI) extends to invaluable peace of mind. Knowing you have experienced legal counsel available at your fingertips—without the anxiety of escalating bills—empowers you to address issues promptly and proactively. This early intervention can prevent minor problems from becoming major crises, saving you not just money, but also time, stress, and emotional toll.

Whether it’s the quiet confidence of knowing your estate plan is in order, the relief of having an attorney review your home buying contract, or the practical assistance with a traffic violation, your MetLife Legal Plan acts as a comprehensive shield. It transforms potentially overwhelming legal hurdles into manageable steps, allowing you to focus on what truly matters in your life, protected and informed. For many, this holistic protection makes the decision to enroll, and actively utilize, their MetLife Legal Plan an intelligent and indispensable investment in their future.

Your Next Steps Towards Legal Empowerment

You now have a robust understanding of how to truly make the most of your MetLife Legal Plan. This isn't just about passive coverage; it's about active engagement with a powerful tool designed to simplify your life.

Your call to action is clear:

- Access Your Member Portal: Log in today. Familiarize yourself with the interface, review your specific plan documents, and understand the full breadth of your benefits.

- Explore the Digital Tools: Test out the "Ask Lexi" chatbot, browse the self-help legal library, and locate the "Ask An Attorney" email feature. These resources are waiting for you.

- Proactively Identify Needs: Think about upcoming life events. Are you buying a home? Do you need to update your will? Could a quick contract review save you future headaches? Don't wait for a problem; prevent one.

- Connect with an Attorney: If you have even a minor question related to a covered matter, reach out. Use the filtering tools to find an attorney who fits your preferences and leverage that first consultation.

Don't let your MetLife Legal Plan be another dormant benefit. Unlock its full potential, embrace the proactive protection it offers, and gain the confidence that comes from having expert legal support always within reach. Your peace of mind is too valuable to leave to chance.